FAQ's

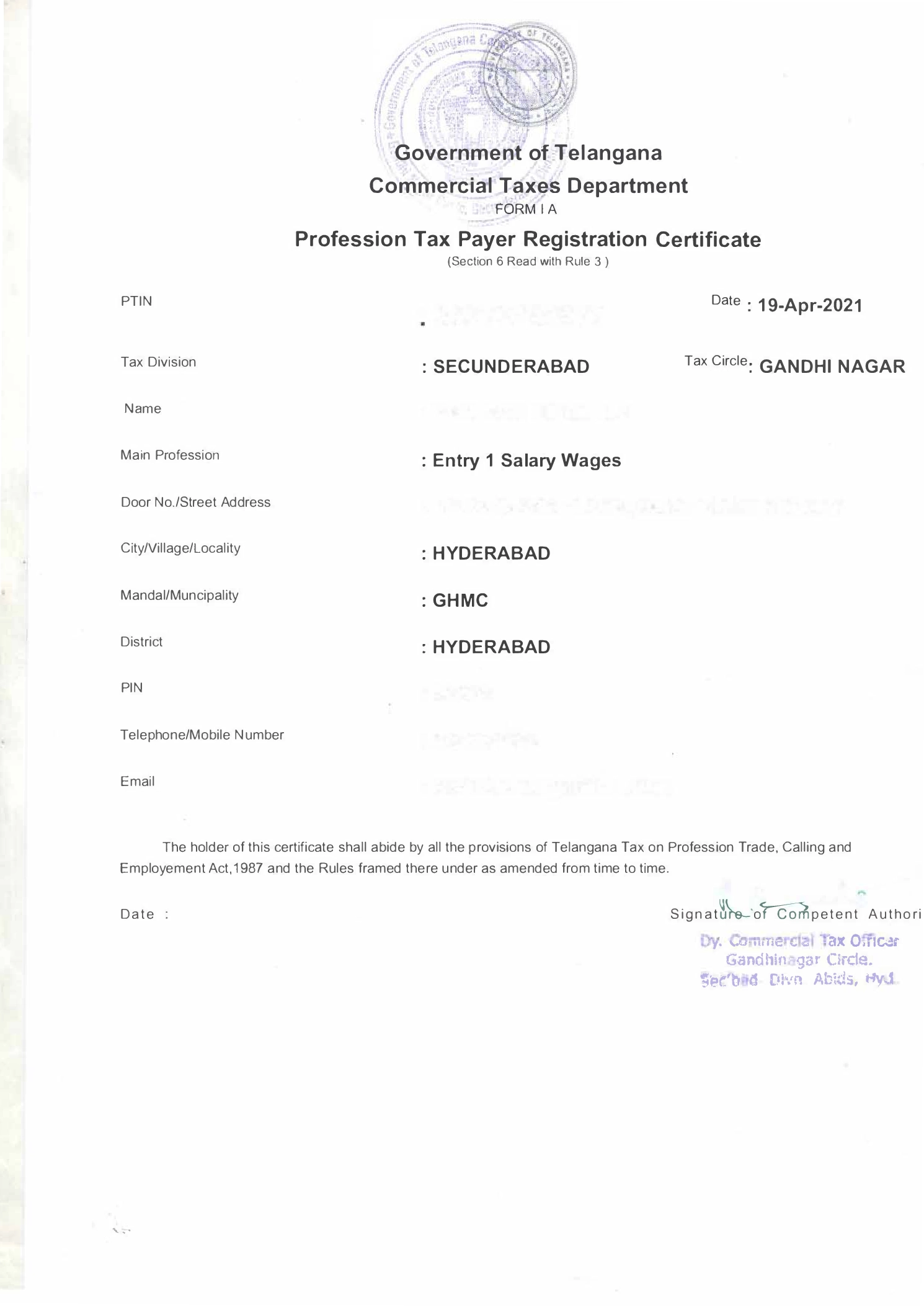

What is professional tax?

Professional tax is a direct tax that is deducted from your gross salary by your employer. It is

levied

by the state government and can vary depending on the state you live in.

Why is professional tax deducted?

Professional tax is deductible from taxable income, and it serves as a source of revenue for most

Indian

territories.

Is professional tax paid monthly or yearly?

Professional tax is paid monthly.

What are the benefits of professional tax?

- Imposes minimal restrictions

- No delay in payment

- Easy registration process

- Supports welfare and development programs

- Professional assistance available

- Claim deductions

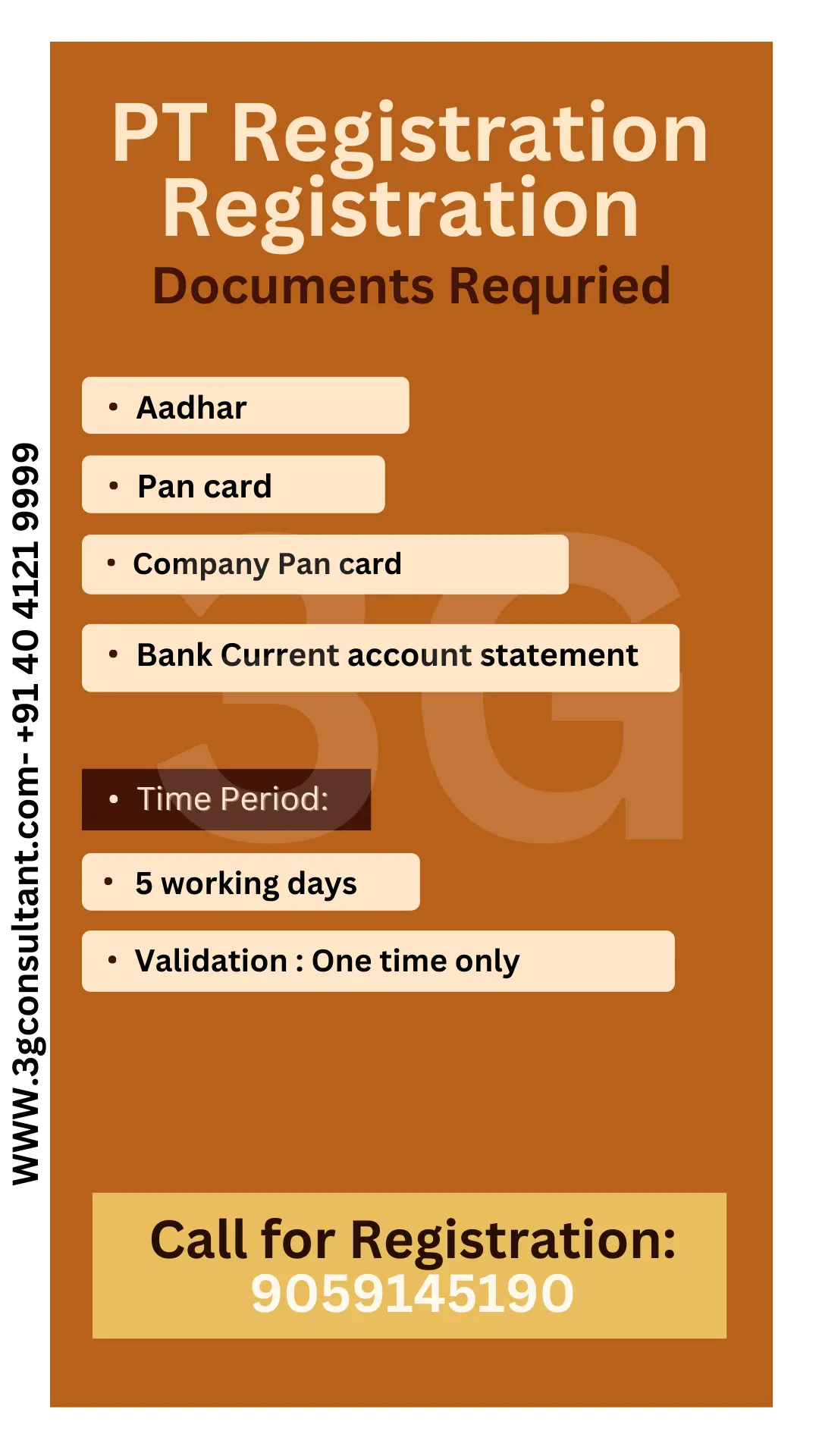

Need effortless professional tax assistance? Contact us at the provided phone

number, and our team will guide you through the process step by step.

Is professional tax deduction mandatory?

Yes, professional tax deduction is mandatory. However, not all Indian states levy professional

tax.

How is professional tax calculated?

- Consider your state's tax slab as some states do not levy professional tax.

- Determine your income bracket within the tax slab.

- Calculate the professional tax payable on a monthly or annual basis.

Calculating professional tax is not very difficult as it depends mostly on the state and income.

Can professional tax be refunded?

Professional tax is non-refundable.

Need help with trade registration? Contact us today for a stress-free experience.

How to register for professional tax?

You can register for professional tax through the following methods:

- Online mode: File the professional tax registration application online on the CTD portal and

upload

supporting documents.

- Courier: File an application online/offline and send supporting documents to the office of the

concerned registering authority through courier.

- In person: Submit the application and supporting documents in person before the concerned

registration

authority.

If you need assistance with filing your professional tax or your employees' professional tax, 3G

Consultant can guide you through the process. Contact us at the provided phone

number.

Who should pay professional tax?

Employers, including corporates, partnership firms, sole proprietors, etc., who are engaged in

trade

or

profession, should pay professional tax.

What happens if you don't pay professional tax?

If you provide wrong information when applying for an enrollment certificate, you may incur a

penalty

three times the amount of your total tax obligation, as specified under section 5(6) of the

Professional

Tax Act. It is important to be thorough with the application process and ensure timely

professional

tax

transactions.

For more information or assistance, you can contact us at 9059145190

or

email us at 3gconsultant01@gmail.com. Get in touch

with us today to ensure smooth professional tax compliance!

Expert Advice

Expert Advice Convenient Support

Convenient Support Affordable Solutions

Affordable Solutions Streamlined Registration

Streamlined Registration